26+ mortgage origination fees

Web A loan origination fee is a charge assessed by a mortgage lender to process your loan. Web An origination fee is money a lender may charge you to complete a loan transaction.

Rockstars Mortgage Team Dallas Tx

The 15-year fixed-rate mortgage was at 626.

. Web Lenders charge origination fees to cover the costs of making loans. Web As the name suggests origination fees are charged by lenders for originating and processing your loan. Web Most mortgage lenders charge an origination fee which is usually around 1 of the total cost of the loan.

Youll also pay lender fees. Web How To Lower Closing Costs. The average closing costs on a HELOC will typically equal 2 5 of the total loan amount or line of credit accounting for all lender.

The amount can be anywhere from 05 to 15 of. It typically amounts to about 1 of your total loan balance. Web Mortgage Refinance No Origination Fee - If you are looking for lower expenses then our comfortable terms are just what you are looking for.

Do You Have to Pay Origination Fees. Origination charges vary from lender to lender though. Todays rate is higher.

On average expect to pay 05-10 of your loans. The purpose of the fee is to cover expenses like. Web Loan origination fees vary by lender and usually depend on how much youre borrowing.

These fees can increase your borrowing costs whether youre taking out a mortgage a personal. Some of the charges included. For example on a 200000 loan an.

Web Origination points are the fees charged by banks in return for reviewing processing and approving your home loan application. Origination fees usually reflect a fairly small percentage of the loan amount. Typically this range is anywhere between 05 and 1.

Web A mortgage origination fee is a charge from your mortgage lender that compensates it for services involved in giving you a loan. Origination points are non. Web How much are loan origination fees.

Web These fees typically include such items as document preparation underwriting appraisal costs credit reports tax research and more. Web The US. Web For example if you take out a 250000 mortgage your origination fees could cost anywhere between 1250 and 3750.

On average a loan origination fee is about one percent of your mortgage. Mortgage Refinance No Origination. Federal Trade Commission on Thursday said it would take action aimed at stopping New York Stock Exchange parent Intercontinental Exchange from.

Web The fee is charged based on a percentage of the loan amount. Web If not it will be a one-line item that covers all origination charges. Web The interest rate is just one fee included in your mortgage.

Many types of loans including personal loans student loans auto. So its important that you review origination.

25 Best Mortgage Brokers Near Colleyville Texas Facebook Last Updated Feb 2023

Subprime Loans What Was The Subprime Mortgage Crisis

4 Best Mortgage Lenders That Don T Charge Origination Fees In 2023

Mortgage Origination Fees What You Need To Know Smartasset

Free 5 Sample Mortgage Commitment Letter Templates In Pdf Ms Word

What Is Loan Origination And Its Fees Moneytips

Mortgage Lending Will Boom Through June 2020 Then Plummet Mba National Mortgage News

Loan Origination Fee Why Am I Paying It

What Is A Mortgage Origination Fee Nerdwallet

What Is A Mortgage Origination Fee Nerdwallet

What Is A Mortgage Origination Fee Nerdwallet

What Is A Mortgage Origination Fee Nerdwallet

4 Best Mortgage Lenders That Don T Charge Origination Fees In 2023

What Is A Loan Origination Fee Better Mortgage Better Mortgage

California S Annual Mortgage Report Card Is Out

Origination Fee For Mortgage Bankrate

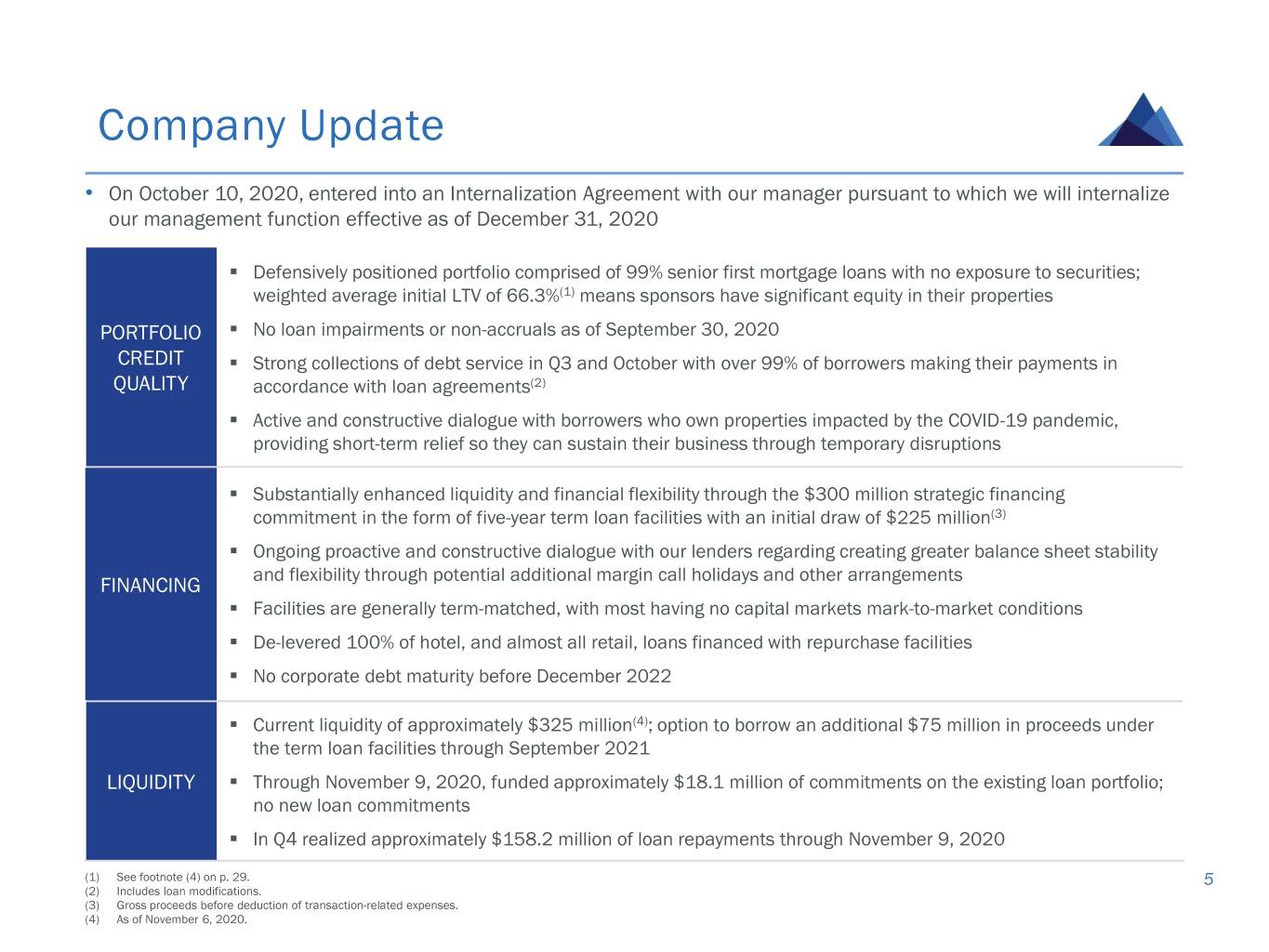

Gpmtq32020investorpresen